How to Know if You Need Farm Mortgage Refinancing

There are several indications that suggest the need for agricultural mortgage refinancing. One of the reasons is high interest rates, where opting for refinancing can result in lower interest rates, leading to cost savings on monthly payments and the overall loan. Additionally, changes in income can prompt the need for refinancing as it can help align monthly payments with one's current financial situation. If there’s a requirement for cash to make farm improvements or cover operating expenses, you should consider our farm mortgage refinance to obtain equity from your farm.

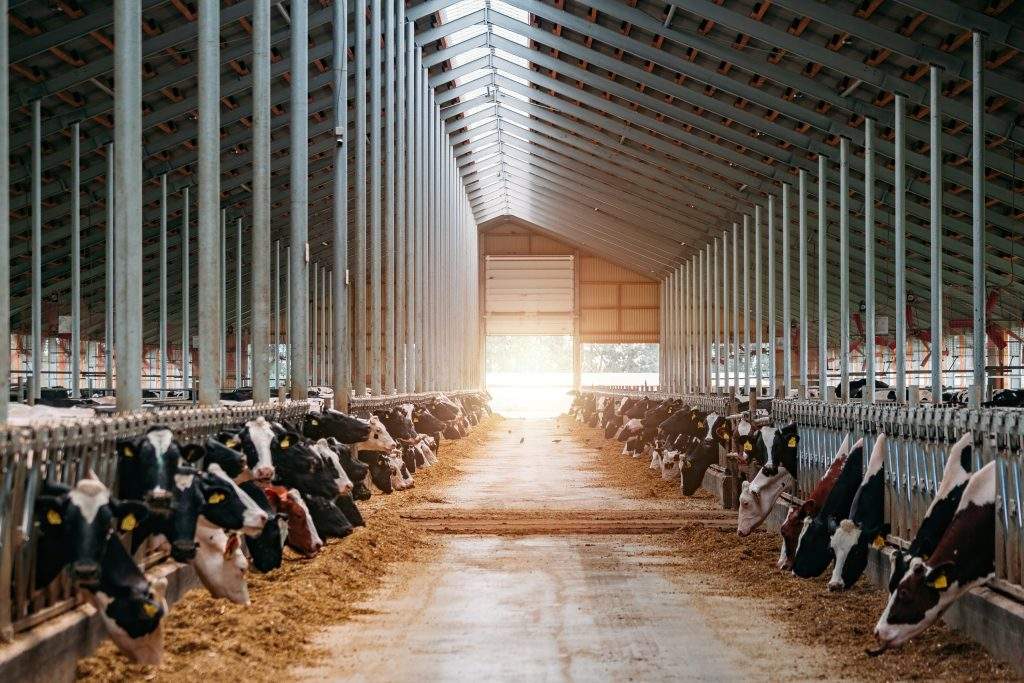

Refinancing Provides Cash for Improvements

At Ag Lending, we offer ranch loan refinancing options that provide our clients with competitive rates, including fixed, variable, and adjustable rates, which could be more beneficial than their current loan. Our ranch loan lending services enable borrowers to leverage the equity they have in their land to pay off debts, manage unexpected expenses, and improve their cash flow. Overall, ranch loan financing offers several advantages, such as enhancing credit scores and providing access to better resources or advanced equipment, which can benefit ranchers in many ways.

Agricultural Lending Made Easy With Our Straightforward Process

We recognize the significance of collaborating with a trustworthy and proficient team, and that’s precisely who we are. Our business is BBB Certified with an A+ rating, and our team is comprised of individuals who are enthusiastic about agriculture. Our ranch loan lending procedures are designed to simplify financing for our clients and eliminate the need for complex and rigorous processes.

We have a dependable and easily accessible customer support team to help you with any inquiries or issues you may have.